Economy

Oil And Gas Operators Are Carting Away The Profits, Leaving Nigerians With Pains

|

Getting your Trinity Audio player ready...

|

Oil and gas operators are carting away the profits, leaving Nigerians with pains

By Business Editor

With persistent fuel scarcity, Nigeria’s oil and gas sector stands at a critical crossroads, grappling with persistent challenges that demand immediate and decisive action. Despite the significant financial strain caused by importing fuel, previous administrations have failed to revitalize the nation’s refineries, leaving a gaping hole in our energy strategy. The Bola Tinubu administration faces an urgent task: to end the cycle of dependency on fuel imports and implement the Petroleum Industry Act (PIA) effectively. With NNPCL’s repeated delays in refinery operations and the need for a level playing field, Group Business Editor SIMEON EBULU writes that it is time for a bold, unwavering approach to address these systemic issues and drive meaningful reform

The sun beats down relentlessly on the bustling streets of Lagos, but it’s more than the heat that’s fuelling the rising tempers. Once again, a familiar and dreaded crisis has gripped the city: petrol scarcity. In a nation where fuel powers the rhythm of daily life, this shortage is far more than an inconvenience—it’s a catastrophe. At a petrol station in Ikeja, a snaking queue of vehicles stretches for miles, winding through the streets and bringing traffic to a standstill. Bleary-eyed drivers, exhausted from hours of waiting, lean on their horns in frustration, but the oppressive heat and thick air of desperation swallow their sounds.

Among the many stranded was Adebayo, a middle-aged taxi driver and father of four. His livelihood depended on the fuel that powered his taxi, and without it, his family’s already precarious existence was at risk. “I’ve been here since 3:00 AM,” Adebayo said, wiping sweat from his brow. “There’s no guarantee I’ll get fuel today. If I don’t, I don’t know how I’ll put food on the table tonight.” The scarcity had driven up prices at the black market, where fuel was sold at exorbitant rates by opportunistic dealers. But for Adebayo, whose earnings barely covered his daily expenses, the black market was not an option. “I can’t afford their prices,” he lamented. “If I buy from them, I’ll lose money with every passenger I carry. But what choice do I have?”

Across town in Surulere, Nneka, a young office worker, stood at the bus stop, anxiously checking the time. It was already 7:30 AM, and there was no sign of the usual danfo buses that ferried people to their destinations. The few buses that did appear were already packed to the brim, with desperate commuters hanging from the doors, clutching onto any available surface for dear life. Nneka had been waiting for over an hour, but each passing minute brought her closer to being late for work—a prospect that could cost her the job she had worked so hard to secure. “My boss doesn’t care about the petrol scarcity,” she said, her voice tinged with worry. “If I’m late, I’m late. I can’t afford to lose this job, but how can I get there on time if there’s no transport?”

The situation was the same in other parts of the city. In Yaba, commuters stood in long lines at bus stops, hoping for a miracle. The scarcity had doubled the usual fare, and many who couldn’t afford the hike were left stranded, helplessly watching as buses passed them by. Even those who managed to squeeze into a bus faced the risk of delays as the vehicles crawled through traffic jams exacerbated by the endless queues at petrol stations.

While commuters struggled to reach their destinations, businesses across Nigeria were feeling the pinch of the petrol scarcity. In the bustling Balogun Market, one of the largest in Lagos, traders who relied on generators to power their stalls were facing an unprecedented challenge. With the scarcity driving up the price of petrol, the cost of running a generator had become prohibitive. Chinwe, a fabric trader in the market, expressed her frustration as she watched customers walk away from her dimly lit stall. “I usually sell a lot by this time of day,” she said, “but without light, people don’t want to come in. My generator has been off for two days now because I can’t afford the fuel. If this continues, I’ll lose everything.”

The impact of the scarcity extended beyond the market stalls. Small businesses that depended on deliveries were struggling to keep up with demand. Delivery trucks sat idle as their drivers searched in vain for petrol, leaving perishable goods to spoil and orders unfulfilled. For many, the crisis threatened not just profits, but the very survival of their businesses. The petrol scarcity is not just a problem for Lagos; it is a national crisis. In cities across Nigeria, the story is the same—long queues, inflated prices, and a populace pushed to the brink of despair. The ripple effects are felt in every sector, from transportation and commerce to education and healthcare.

Why federal government should take a decisive action

Serious concerns are mounting over the ongoing scarcity of petroleum products in the country, exacerbated by allegations of adulterated fuel being sold at some retail outlets. Nigerians from all walks of life—manufacturers, professionals, artisans, and operators in the petroleum and gas sectors, to name a few—are increasingly worried that, unless the Federal Government takes decisive action to address the troubling developments in the administration of Nigeria’s oil and gas sector, the repercussions could be severe, not only for the economy but for the overall wellbeing of the citizenry.

These concerns are heightened by recent developments in the industry. A significant issue currently facing the sector involves allegations made by Dangote Refinery, accusing those in charge of the nation’s oil and gas industry of favouring the importation of petroleum products over ensuring the functionality of local refineries. The company also claims that certain key officials within the NNPC are implicated in owning a refinery in Malta, from where they have been importing substandard products into Nigeria.

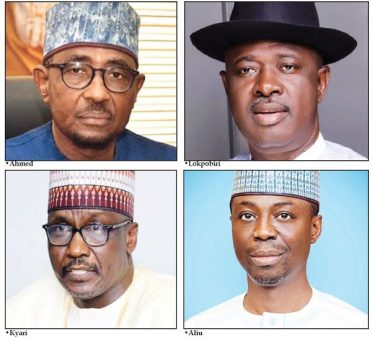

As expected, those implicated in the allegations quickly issued denials. Not only did they absolve themselves of any wrongdoing, but they also challenged anyone with evidence to come forward. The Group Managing Director of NNPCL, Mele Kyari, and the Managing Director of the Nigerian Midstream and Downstream Petroleum Regulatory Authority, Farouk Ahmed, both denied any involvement, daring anyone to prove that they own a refinery abroad.

However, the controversy did not end there. Just days later, another allegation emerged, once again stirring the waters of the nation’s oil industry. This time, Oando, a major player in the sector, was implicated. The company swiftly denied the accusation, issuing statements to both the Nigerian Stock Exchange in Lagos and the Johannesburg Stock Exchange in South Africa, where it is listed, asserting that it had no involvement with the alleged refinery in Malta. This denial seemed to put the matter to rest—until last Friday, when The Cable reported that Matrix Energy, an oil retail outlet, was the actual importer of petroleum products from Malta. This revelation reignited the debate, bringing the issue back into the spotlight. While Matrix Energy acknowledged its involvement in the importation of petroleum products, the company maintained that the products it imported were not adulterated.

Matrix Energy Group

At the helm of Matrix Energy Group is Abdulkabir Aliu, who serves as the Group Managing Director and is also a member of the Presidential Economic Coordination Council. The leadership team at Matrix Energy includes notable figures such as Luqman Salam-Alada, Executive Director of Downstream; Aisha Said-Aliu, Group Head of Business Development and Strategy; Oluwatoyin Showunmi, Executive Director of Retail; Olabisi Sogunro, Group Head of Support Services; and Olajide Aogo, Managing Director of the group’s fertilizer arm.

When Aliu appeared before the Senate Committee, which was established to investigate the allegations of importing adulterated or substandard petroleum products, he addressed the concerns directly. Aliu stated: “Matrix in Nigeria has over 2700 staff and we have invested in the country because we believe in this country. We’re being accused of bringing products from Russia and some other countries. It’s strange to me as we are not aware that Nigeria has banned, or stopped importation of products from some countries. The most important thing to us and every government is to make goods and products available to the people at affordable price.”

The Chief Executive Officer of Matrix Energy Group, Aliu, is reportedly well-connected within the corridors of power, particularly with the management of NNPCL and its subsidiaries. Sources indicate that Aliu’s relationship with the NNPCL dates back to the first term of the Buhari administration, long before the current government took office. Investigations have revealed that Matrix Energy played a pivotal role during a financially challenging period for the NNPCL. At a critical time, the company reportedly provided financial assistance to NNPCL, helping to stabilise its operations. In return, Matrix Energy was allocated crude oil cargoes, which it exported for refining abroad and then re-imported into Nigeria as refined products. This arrangement not only solidified the company’s standing in the industry but also deepened its ties with NNPCL.

To further corroborate the close relationship between Matrix Energy Group and NNPCL, a source, who requested anonymity, explained, “I’ll keep it brief, but there’s a lot to unpack. Since the year 2000, Nigeria’s subsidy burden had already started to strain the economy and NNPC’s balance sheet, significantly increasing their debt liabilities.” The source continued, explaining that in 2005, NNPC made a strategic decision to mortgage oil production from OML 119, specifically 20,000 barrels per day, as a means of debt repayment. OML 119 is an offshore asset comprising the Okono and Okpoho fields and is particularly significant because it is one of the eight Oil Mining Leases (OMLs) where NNPC holds 100% equity.

According to the source, from 2005 to the present, the revenue generated from OML 119 has not been remitted to the Federation Account. Instead, it has been used to offset various debts, including subsidy payments by the NNPC. This diversion of funds further highlights the intricate and long-standing financial manoeuvres that have tied Matrix Energy Group and NNPCL together.

By 2012, NNPC’s debt had escalated to $8.5 billion. To address this substantial liability, $5 billion, which represented dividends from Nigeria Liquefied Natural Gas (NLNG), was used as part payment towards the debt. The remaining $3.5 billion was secured against the daily production of 20,000 barrels from OML 119. This arrangement was structured under special purpose vehicles (SPVs) named PXF1 and PXF2. PXF1 was designated for a five-year term, while PXF2 was set for a seven-year term, extending the repayment period for this portion of the debt.

“In 2020, at the height of COVID 19, Nigeria had shortfall of revenue, NNPC had to make a pre-payment plan of $1.5 billion with Matrix and Vitol. Repayment was going to be from daily production of 30,000 barrels of crude oil from another OML in which NNPC has 100 % equity, and it will run for 5 years under an SPV called Project Eagle

“The daily 30,000 barrels of crude oil given to Matrix and Vitol for their “loan” of $1.5 billion during Covid-19, is what is taken to Malta , refined/blended ( to be cheaper ) and sold to Nigerians. By the end of 2024, the 12-year deal to repay $3.5 billion will end. By the end of 2025, the 5-year deal to repay Matrix and Vitol their $1.5 billion will also end. That is all I have to say,” the source said.

An investigation by The Nation revealed that other operators in the oil and gas sector have taken a keen interest in Matrix Energy Group due to its “unusual rise” in the industry. Despite not being a particularly large firm, Matrix Energy’s rapid expansion has drawn attention for its deviation from typical growth patterns in the sector. According to one industry insider, the company’s remarkable progress and staggering volumes of activity have raised eyebrows. In July 2024 alone, Matrix Energy received approximately 25 per cent of Nigeria’s monthly petrol consumption into its storage facility. This figure is notably striking, especially considering that the company operates fewer than 160 filling stations nationwide. To industry players, such a significant share of the national fuel supply, coupled with relatively modest retail infrastructure, is highly unusual and has fuelled speculation about the company’s rapid ascent.

In the first week of August, Matrix Energy Group was reported to have discharged a petroleum product-laden vessel at a facility owned by Pinnacle Oil and Gas in the Lagos Free Zone. The vessel in question, MT ROMEOS, had its load port clearly identified as OPL MALTA. While the client for the petroleum products was listed as NNPC Retail, it is widely recognized that Matrix Energy Group, as one of NNPCL’s trading partners, likely conducted the operation on behalf of its client. This arrangement underscores the intricate connections and operational dynamics within the sector.

UPSTREAM ACTIVITIES AND THE NNPC CONNECTION

• About 4 crude cargoes per month are allocated to Matrix Energy by NNPC (Tables)

The crude allocations to Matrix are traded by Gulf Transport & Trading (GTT), a trading company registered in the UAE

•Two of the three crude cargoes of the recently launched Utapate grade were allocated to GTT.

The crude cargoes are typically sold at a $3 per barrel premium which translates to $3 million per cargo . This implies a profit of almost $150million per year or N240 billion at the prevailing #1590/$

• They also have three marginal fields prospecting licences as listed on their website

DOWNSTREAM ACTIVITIES AND THE RUSSIA/MALTA CONNECTION

• Matrix Energy is also active in the downstream sector. They own a 150 million litre capacity depot in Warri (Bluefin Depot), three old ships (Matrix Pride, Matrix Triumph, Matrix S.ILU), and about 500 trucks

• They are very active in the import of Russian products through various blending locations.

• Import of low-grade fuel from Russia

• Import of petroleum products from Malta

As previously noted, in July alone, approximately 25% of Nigeria’s monthly PMS consumption was allocated to Matrix Energy Group, a relatively small player in the industry.

Our position, by Matrix Energy

Amid the ongoing revelations, the company has issued a statement distancing itself from any involvement in the importation of adulterated fuel. The statement reads: “Our attention has been drawn to a recent online publication where our name was mentioned. While we might have preferred to overlook the fabrications in the publication, we feel compelled to correct the record and distinguish fact from sensationalism. It is crucial for us to address this matter to protect and uphold the integrity of our brand and the reputation we have diligently built over the past 20 years.”

In a statement signed by Ibrahim Akinola, Head of Communications at Matrix Energy Group, the company emphasised its commitment to compliance with approved specifications for imported products. Akinola stated, “Matrix Energy Group remains steadfast in adhering to the rigorous standards required for imported products. We have consistently ensured that our products meet all approved specifications and have never been found wanting in this regard.”

Akinola said: “Our company is recognised and approved by global international companies, national oil companies, major construction firms, and various end-users. “Our consistent ability to deliver on all contracts at competitive prices has solidified our strong position in the industry today,” adding that the Chief Executive Officer of the company, Abdulkabir Adisa Aliu, is a member of President Tinubu’s Economic Coordination Council.

The statement noted that Aliu’s selection by Mr President to serve as a member of the Economic Coordination Council is a recognition of his dedication to shared values and his commitment to the betterment of Nigeria in the Renewed Hope Agenda, for which he remains deeply grateful. Matrix Energy Group, Akinola said, “is a wholly indigenous and independent oil marketing and trading company, with substantial investments in strategic infrastructure, including vessels, oil and gas terminals, trucks, and retail outlets across 28 states, including the Federal Capital Territory (FCT).”

He added: “Our company is recognised and approved by global international companies, national oil companies, major construction firms, and various end-users. Our consistent ability to deliver on all contracts at competitive prices has solidified our strong position in the industry today.”

Why Fed Govt should act

At this critical juncture, the challenges plaguing Nigeria’s oil and gas sector must be addressed with unwavering seriousness and resolve. The refineries need to be operational, and our dependence on fuel imports must come to an end. The bulk of our precious foreign exchange is spent on importing fuel, which is unsustainable. Previous administrations have failed to fix the four refineries with a combined capacity of 420,000 barrels of crude oil. The Tinubu administration must break from this pattern and make a tangible difference. NNPCL must step up its efforts; it has repeatedly postponed the resumption of production at the Port Harcourt refinery since May of last year.

The Petroleum Industry Act (PIA) must be fully implemented. The government has stated that crude should be allocated to local refineries with payments made in Naira. It is time for the government to enforce this directive firmly and ensure a level playing field for all stakeholders. The era of untouchable figures and sacred cows must end. The focus should be on fixing the sector decisively, not on shifting blame. The time for action is now. Enough of the blame game.